Overview of Financial Markets

The financial markets are a complex ecosystem that encompasses various asset classes, including stocks, commodities, currencies, and cryptocurrencies. These markets serve as a platform for investors to buy and sell assets, with the goal of generating returns. The global nature of these markets means that they are influenced by a wide range of factors, from economic indicators to geopolitical events.

Key Asset Classes

- Stocks: Represent ownership in companies and are traded on stock exchanges. They offer potential for capital appreciation and dividend income.

- Commodities: Include raw materials or primary products such as gold, oil, and agricultural goods. These are often used as hedges against inflation.

- Currencies: Involve the exchange of one currency for another, influenced by interest rates, economic stability, and political factors.

- Cryptocurrencies: Digital or virtual currencies that use cryptography for security. They have gained popularity due to their decentralized nature and potential for high returns.

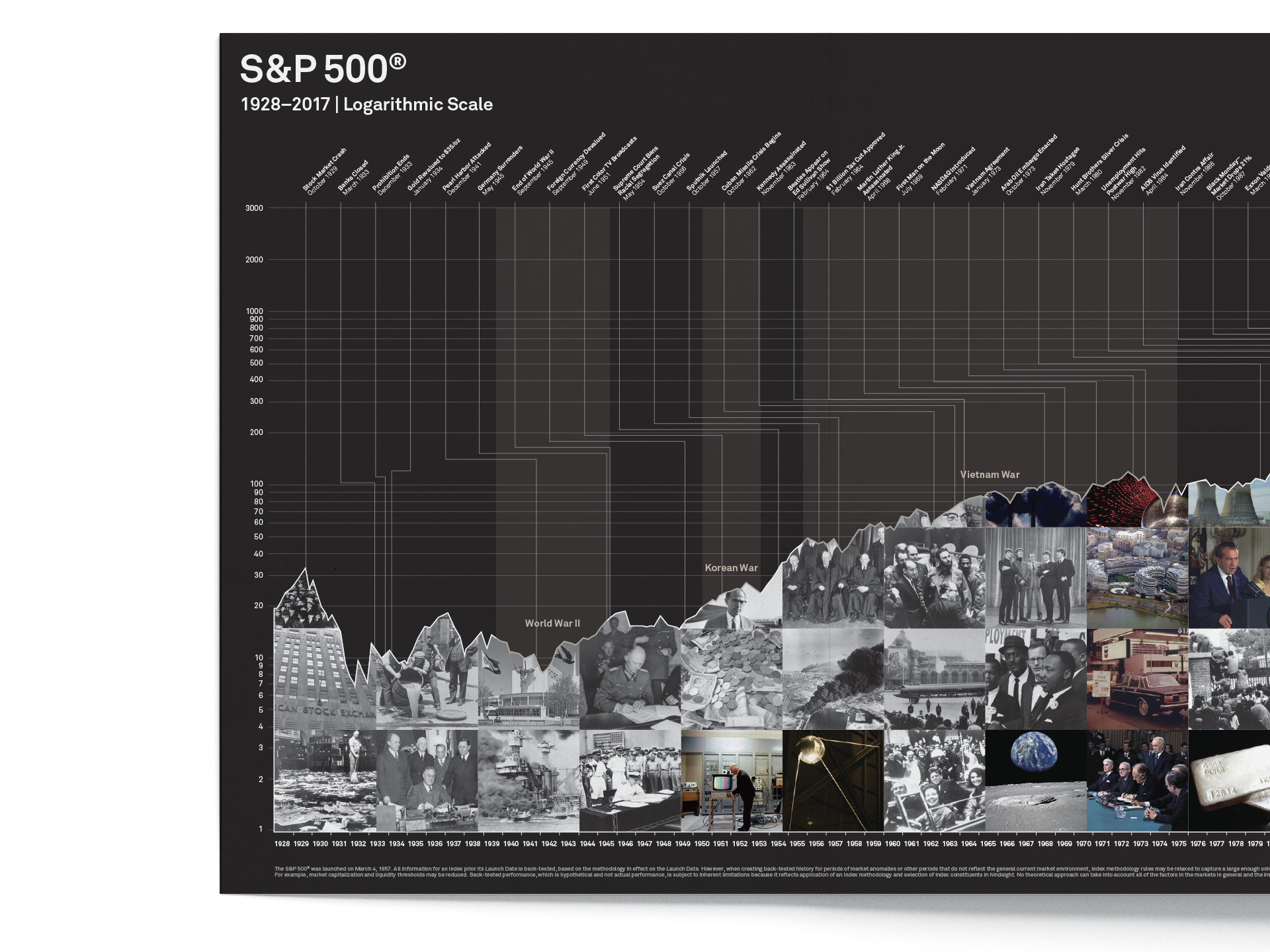

Market Indices and Futures

Market indices provide a snapshot of the performance of a particular segment of the market. For example, the S&P 500 and Dow Jones Industrial Average are widely followed indices that reflect the health of the U.S. stock market. Futures contracts allow investors to speculate on the future price of an asset, providing a way to hedge against potential losses.

- Indices: Examples include the DAX, FTSE 100, and Nikkei 225, which track the performance of major European and Asian markets.

- Futures: Contracts for the S&P 500, Nasdaq, and other indices enable traders to bet on the direction of the market without owning the underlying assets.

Commodities and Energy Markets

The commodities market includes a variety of goods such as metals, energy, and agricultural products. These markets are essential for understanding the supply and demand dynamics that influence prices.

- Metals: Gold, silver, and copper are key players, often seen as safe havens during times of economic uncertainty.

- Energy: Crude oil and natural gas are critical for global economies, with prices influenced by geopolitical tensions and production levels.

- Agricultural Products: Wheat, corn, and soybeans are vital for food security and are affected by weather patterns and crop yields.

Currency Exchange and Foreign Exchange Markets

Currency exchange involves the buying and selling of different currencies, which is crucial for international trade and investment. The foreign exchange (forex) market is the largest financial market globally, characterized by high liquidity and volatility.

- Major Currencies: The U.S. Dollar (USD), Euro (EUR), British Pound (GBP), and Japanese Yen (JPY) are among the most traded currencies.

- Exchange Rates: Fluctuations in exchange rates can impact trade balances and investment returns, making it essential for investors to monitor these movements.

Cryptocurrency and Digital Assets

Cryptocurrencies have emerged as a significant asset class, offering new opportunities for investors. Bitcoin, Ethereum, and other digital assets have gained traction due to their potential for high returns and innovative technology.

- Bitcoin: The first and most well-known cryptocurrency, often viewed as a store of value.

- Ethereum: A platform for building decentralized applications, with its own native cryptocurrency, Ether.

- Other Cryptocurrencies: Includes altcoins like Cardano, Solana, and Dogecoin, each with unique features and use cases.

Investment Tools and Resources

Investors have access to a variety of tools and resources to aid in their decision-making processes. These include:

- Stock Screeners: Allow users to filter stocks based on specific criteria such as price, volume, and financial metrics.

- Economic Calendars: Provide information on upcoming economic data releases that can impact market movements.

- Currency Converters: Help investors understand the value of different currencies in real-time.

Risk Management and Market Analysis

Understanding the risks associated with investing is crucial for long-term success. Market analysis involves evaluating economic indicators, company fundamentals, and technical charts to make informed decisions.

- Risk Disclosure: Investors should be aware of the potential for loss and the importance of diversifying their portfolios.

- Technical Analysis: Involves using historical price data and charts to predict future price movements.

- Fundamental Analysis: Focuses on the financial health of companies and broader economic factors.

Conclusion

Financial markets are dynamic and ever-changing, presenting both opportunities and challenges for investors. By understanding the various asset classes, utilizing available tools, and managing risks effectively, investors can navigate these markets more confidently. As the financial landscape continues to evolve, staying informed and adaptable is key to achieving long-term success.

0 comments:

Post a Comment